Best Discount Broker In India

I have been trading with some of the best discount broker in India ever since I first opened my account with Zerodha way back in 2012. Before that, I used to trade through Sharekhan and ICICIDirect who were charging on percentage basis.

I could not resist the brokerage that was possible to save by switching to discount brokers, even though Zerodha was not as established as today. I was skeptical and worried about safety of my money with them.

However, discount brokerage concept is widely accepted now in our county and let me discuss about Best discount brokers in India in this article.

For complete list of best stock brokers of India which includes both discount and full service brokers, you can check out this article.

I am going to provide a list of India’s Top 10 Discount stock Brokers in no particular order or preference. But if you feel the list needs to be revised by including/excluding any of the below mentioned major discount brokers, please do let me know through comments.

Before that, let us understand about Discount Stock Broker and what are the features they offer to us.

Who is a Discount Broker?

Discount Brokerage was very well established concept in eastern countries before it was introduced in India by Zerodha in year 2010.

Discount Broker is a broker who charge reduced brokerage rates compared to full service brokers. But they do not provide investment advice , one to one support etc .

They just provide the bare minimum infrastructure required to enable customer to carry out trading. Normally they charge flat fee of approximately Rs 20.(irrespective of the trade size)

Compared to this, full service brokers charge on percentage of trade size (Usually 0.3%).

So as you can make out, discount brokers are best for the ones like me who already have some trading experience and do not need any initial hand holding.

Also Read : 9 Brokerage houses offering Best Demat and Trading Accounts in India

Now lets come back to the list of Major discount brokers of India and then I’ll provide brief information about each one of them.

Ranking For Best Discount Broker in India 2024:

Discount brokers helps to trade with reduced costs and offer minimal support. There are many good discount brokers operating in India.

Here is the list of 10 best discount brokers in India:

- 1. Zerodha discount broker

- 2. Upstox discount broker

- 3. Angel One discount broker

- 4. SAS Online discount broker

- 5. 5Paisa discount broker

- 6. Trade Smart Online discount broker

- 7. FYERS discount broker

- 8. Tradeplus discount broker

- 9. Tradejini discount broker

- 10. Prostocks discount broker

#1. Zerodha Discount Broker

Zerodha is the best discount broker in India offering free investments and outstanding products. Zerodha is my favorite ever since I opened account with them.

They charge Rs 20/ Executed order. And the good part is, this Rs 20 is also waived off if you don’t sell your shares on same day (Delivery Transactions)

That means, they charge zero brokerage on all investments and Rs 20/order for trading.

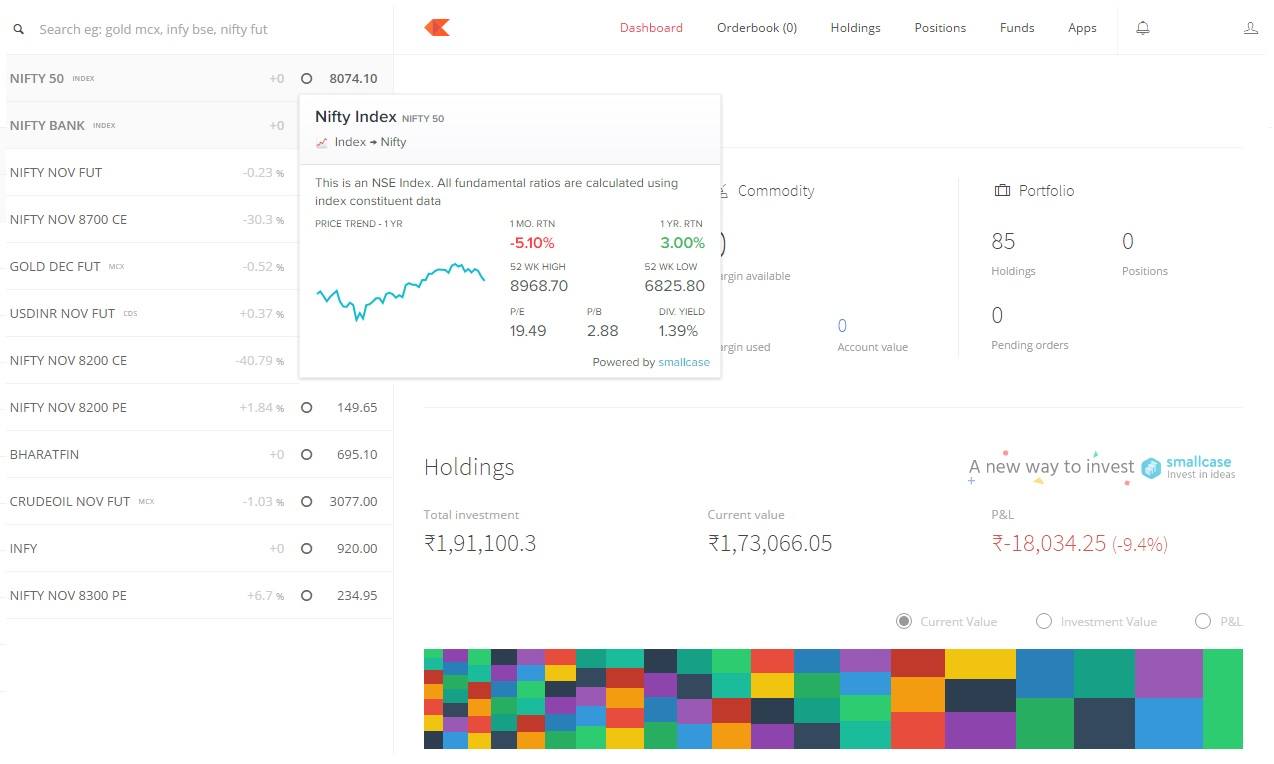

The trading platform offered by them is called KITE and is very neat and has distraction free interface. It lets me to concentrate on what is important to me (my trade) instead of clutter.

Zerodha Brokerage Charges

What this means is, the maximum brokerage you pay is capped at Rs20 for each trade wheather your trade size is 1Lakh or 100 crore.

This works out to be very cheap and I could save significant amount of money after I switched to Zerodha from Sharekhan.

Below are some of the other aspects of them which I liked and disliked.

Cons of Zerodha:

- Not possible invest in IPOs directly

- Call and trade is chargeble

Pros of Zerodha:

- Free delivery based trades and maximum of Rs20/trade in other segments

- First Discount broker of India and Best discount broker with highest number of customers

- Taken initiative to educate common investors through open platform Zerodha Varsity

- State of the art trading platforms such as Zerodha Kite

- New direct mutual fund investment platform called Coin

I have written detailed review of Zerodha discussing their account opening fees, brokerage plans, trading platforms and exposure margins.

Account with Zerodha can be opened online in 15 minutes and it is completely paperless. You can refer this article on procedure to open Zerodha account online.

Zerodha Account Opening Charges:

Zerodha has made account opening free with effect from June 29, 2024. Use below link to go directly to Zerodha account opening page to open the Zerodha demat account without any fees.

#2. Upstox Discount Broker

Upstox is another popular discount broker based out of Mumbai. They also started almost same time as Zerodha. They are the biggest discount broker next to Zerodha.

Initially they were known as RKSV and had monthly unlimited plans.

In due course, they had followed Zerodha’s path and abolished all the unlimited plans and now they charge exactly same as that of Zerodha.

Checkout the side by side comparison of Upstox with Zerodha.

Recently they got funding from Kalari Capital backed by Mr.Ratan Tata.

Their trading platforms are also built in house and come with lot of features.

They have opened their branches in Pune Ahmedabad and Delhi.

Upstox Brokerage Charges

Other advantages and disadvantages of Upstox are,

Cons of Upstox:

- Pricing is almost similar to Zerodha

- Average customer care

Pros of Upstox:

- Zero commission on delivery trades

- Free Demat account opening and lower annual maintenance charges

- Maximum Rs20 Per trade for non delivery trades

- Superior Trading platform Upstox Pro

You can read my detailed review of Upstox here.

Upstox currently offering 100% free demat account. There is no account opening fee. Use below button to avail the offer.

#3. Angel One Discount Broker

Angel One re-branded themselves as discount broker by adopting discount brokerage model in 2019.

Earlier to 2019, they followed full service brokerage model. But owing to competition, they have slashed the brokerage rates.

They are probably oldest discount broker of India established in 1987. Apart from trading, they also have wide gamut of services like mutual funds, bonds, life insurance and Portfolio Management Services (PMS).

To know more about Angel One, read this detailed review.

Below table has the details of brokerage charges of Angel One. It is same as that of Zerodha ( Checkout Angel One Vs Zerodha comparison)

Angel One Brokerage Charges

Drawbacks of Angel One:

- Non availability of fixed per month brokerage plans

- The recommendations are mainly from robotic based and purely depends on their algorithms

- Call and Trade is charged Rs20

Benefits of Angel One:

- One of the most trusted brand of India

- Advanced trading platforms

- New investment vehicle based on Artificial Intelligence (ARQ)

- Large network of sub brokers and franchises

- Good team of research analysts providing research reports and tips

Current Offer : Account Opening charges has been waived off at Angel One. Also No AMC charges for first year. To avail these offers, use below button.

#4. SAS Online Discount Broker

One of the cheap and best discount broker in India if your main goal is to save on brokerage. Though not as big as first two in the list, they are making their mark especially in north India.

Their brokerage charges are as low as Rs 9/ Executed order. They also have monthly unlimited plans at Rs 999 for equities and Rs 499 for Currency.

They are based out of Delhi and don’t have any other branches.

SAS Online Brokerage Charges

As per me, following are the Pros and Cons of SASOnline

Advantages of SAS Online:

- Lowest Brokerage in discount brokerage industry (Rs 9/trade)

- Availability of unlimited trading plans (Rs 999/month)

- Maximum Rs9 Per trade for non delivery trades

Disadvantages of SAS Online:

- Not so good back office

- Average Customer care

You can read my detailed review of SASOnline here.

And if you would like to reach out them, you can do so using below button

#5. 5Paisa Discount Broker

Promoted by India Infoline (IIFL) (One of the reputed full service stock broker of India), 5Paisa offers flat fee structure.

Good part is , they provide free research and recommendation to their client. Being a discount broker, this is one of this kind.

However, I feel their account opening fee is very high(Rs 650 and Annual Maintenance Charges (AMC) of Rs 400/year).

Brokerage Charges Of 5Paisa Discount Broker

Other parameters which I liked and disliked about 5 Paisa are,

Drawbacks of 5Paisa:

- Not so good mobile trading app

- No provision to trade in commodities

Benefits of 5Paisa:

- Subsidiary of India Infoline which is one of the well known full service stock broker

- Free research and reports

- Good trading platforms

Read my complete 5Paisa Review here.

Open Free trading account using below button,

#6. TradeSmartOnline Discount Broker

TradeSmartOnline is one of the Top ranked discount broker of India promoted by their parent group VNS financial Services. The parent company is into stock broking for more than 2 decades in Mumbai.

Sensing the opportunity in low cost trading , they started their discount brokerage arm called TradeSmartOnline.

Their brokerage plans are competitive and charge Rs 15/executed order.

They also don’t have unlimited plans. But they have one more plan where 0.007% for intraday, 0.07% for Delivery and Rs 7 / lot is charged for options.

Second plan is for traders who buy and sell small amount say Rs 100 buy and sell it for Rs 105.

Trade Smart Online Broking Brokerage Charges

Below are some of pros and cons of Tradesmart Online broker,

Disadvantages of TradeSmart Online Discount Broker:

- No tips and recommendations provided

- No Support for IPO and Mutual funds investments

Advantages of TradeSmart Online Discount Broker:

- Availability of Multiple trading plans

- Support for Algo trading through NEST platform

- Low brokerage and no minimum balance requirement

- Free tools like Span Margin Calculator and Brokerage Calculator

You can read my detailed review of TradSmartOnline here.

Use below button to avail exclusive promotional offer to get the waiver on account opening charges

#7. FYERS Discount Broker

FYERS started their operation comparatively late and with much focus on the technology.

They have invested much of their time and money on developing better trading platforms. Initially they priced their charges at Rs 100/executed order.

Due to heavy competition now they have reduced it to Rs 20/order. Account opening charges are also waived off now.

But they don’t have their own DP and have tie up with IL&FS to open demat account.

FYERS Brokerage Charges

Following are some good and not so good parts of FYERS,

Cons of FYERS Securities:

- Company is new and hence not established yet

- No support for commodity segment

- No DP of their own (IL&FS demt is opened and linked)

Pros of FYERS Securities:

- Excellent trading platforms with advanced features

- Automated trading is possible

- Pricing structure is reasonable and competitive

Check out my detailed review of them at FYERS Review.

Follow below button to open free trading account

#8. TradePlusOnline Discount Broker

TradePlus is discount brokerage arm of Navia markets, again one of the leading stock broking firm of India.

Pricing is also one of the lowest, with only Rs99/month for unlimited trading for equities and options seperately. For Futures, it is Rs 799/month.

They don’t have any pay as you trade plans. I think they make up for the lower charges through higher transaction charges. Also call and trade is very high with Rs 75/ call.

TradePlusOnline Brokerage Charges

Other Pros and Cons of Tradeplus are,

Cons of TradePlusOnline:

- Very less exposure (Margin) compared to other brokers

- Except brokerage all other charges are high

Pros of TradePlus Online :

- Cheapest per month brokerage charges of Rs99 for each segment

- AMC charges for 5 and 10 years are available and at very low cost

You can read detailed review of TradePlusOnline here.

Like to contact them for any queries, request call back through the below button.

#9. Tradejini Discount Broker

Tradejini has strong presence in and around south India. They have single office at Bengaluru.

Their brokerage charges are reasonable with Rs 20/executed order.

However, I don’t see them investing in developing their own in-house trading platforms. They still depend on NSE NOW and NEST platforms (Offcouse, these are the top notch platforms but as others have moved to their own platforms, Tradejini has to take initiative to remain competitive).

Tradejini Brokerage Charges

Advantages and Disadvantages of Tradejini are,

Drawbacks of Tradejini:

- No in-house developed trading platform like Zerodha and Upstox

- Only non-agricultural commodity trading is allowed

Benefits of Tradejini:

- Unlimited trading across all segments for first 30 days

- High Exposure for intraday trades

- Maximum Rs20 Per trade for non delivery trades

- Variety of investment products

You can read my complete review of Tradjini here.

You can reach them through the button below,

#10. PROSTOCKS Discount Broker

Again, Prostocks also entered lately to industry. They claim to have lowest stamp duty charges.

They have various brokerage plans including Flat fee, monthly and yearly packages.

Flat Fee Plan : Rs 15/order; Monthly Plan : Rs 899 ; Yearly Plan : Rs8999.

However, the exposure margin provide by them is not great and you can not trade commodities with them.

Prostocks Brokerage Charges

Pros of Prostocks:

- Stamp duty is capped at Rs50 hence lower breakeven cost

- Availability of flexible brokerage plans to suit customer preference

- Fully online method of account opening through Aadhaar

Cons of Prostocks:

- Commodity trading is not offered

- Margin provided by the broker is low compared to others

- Mobile trading app need to be improved

Read my complete review of Prostocks here

Use below button to open free trading account.

You May Be Also Interested In:

Best Discount Broker in India – Conclusion

Gone are the days when I used to pay as high as Rs 550 to purchase shares of worth Rs 1 lakh just in the form of brokerage. Thanks to some of these top discount brokers, Indian traders and investors like me can think of implementing a trading strategy which can be profitable.

In my opinion, the options traders are the most benefited from discount brokers. Initially they used to pay per lot and no trading strategy used to work.

Finally, it is very difficult to hand pick top discount broker in India out of these brokers. We have to consider various rating and ranking factors to evaluate them. However, I have short listed them based on my experience and feedback.

I like the clean and clutter free trading platform (KITE) which allows me to focus on my trade and what is actually required.

If I have to tell from my journey so far, I found Zerodha as best in class. They are the No.1 discount broker in India for a reason.

I have been trading with them since 2012 and pretty satisfied.

As I said earlier, if you have experience with any other firm which you think can be considered as one of the these best discount broker of India, kindly let me know through comments.

You May Also Like To Read :

- 10 Best Discount Brokers of India who can reduce your trading costs significantly

- 6 Stock Brokers of India well suited for Options trading

- 5 Best Stock Brokers for Day trading (Intraday trading) in India

- Top 7 Commodity brokers of India to trade in Commodity Segment

- Stock Brokers Best suited for applying to IPO Investments

- 10 Leading Brokers who provide High Margin and also Low Brokerage

- Stock Brokers Who are Known For their Best Customer Service in India

- List of Stock Brokers having Highest Active Clients in India

- Tool to do Side By Side Comparison of Any Two Stock Brokers of India

- Find the Best Stock Broker In Your City

- How to Choose the Best Stock Broker In India as per your Requirement

Best Discount Broker in India – FAQs

Q1: What is a Discount Stock Broker?

Answer: A discount stock broker is a form of stock brokerage company that provides trading services at cheaper brokerage rates compared to regular full-service brokers. Discount brokers usually provide a state-of-the-art trading platform in comparison to traditional brokers.

Q2: Are discount stock brokers safe to use?

Answer: Yes, discount stock brokers in India are regulated by SEBI – Securities and Exchange Board of India and must follow strict guidelines and comply with strict regulatory guidelines. But when selecting the broker, you should always conduct your own research and due diligence.

Q3: How do I choose a discount stock broker in India?

Answer: When choosing a discount stock broker in India, take into account aspects such as commission costs, customer support, features of the trading platform, and regulatory compliance. It is also crucial to go through online reviews and evaluate the broker’s products.

Q4: What are the benefits of using a discount stock broker?

Answer: The main advantage of using a discount stock broker is that they have lower brokerage charges, which can save you money on trading fees. Discount brokers usually provide user-friendly trading platforms with access to a diverse range of investment products.

Q5: Can I trade all types of securities with a discount stock broker?

Answer: Most discount brokers in India provide services in trading for a wide range of securities, including stocks, mutual funds, Exchange Traded Funds (ETFs), and derivatives. To know which precise products can be traded, it is crucial to speak with your broker.

Q6: How do I open an account with a discount stock broker in India?

Answer: Normally, you need to provide personal and financial information, such as your PAN card, Aadhar card, bank account number, and proof of address to open an account with a discount broker. Typically, the procedure can be finished online or with a mobile app.

Q7: Which are some of the popular discount stock brokers in India?

Answer: In India, popular discount stock brokers include Zerodha, Upstox, 5paisa, and TradeSmartOnline. But before making any decision on selecting the broker, it is important to compare offerings from multiple stock brokers.